Candlestick Patterns have you heard it anywhere? In the dynamic world of economic markets, adept buyers use various strategies to make informed selections. Among these strategies, the mastery of Candlestick Patterns is a cornerstone for achieving steady achievement in trading. In this comprehensive guide, we delve into the 5 most effective Patterns that empower buyers to navigate the complexities of the marketplace with accuracy and confidence.

Introduction

In a trendy speedy-paced economic landscape, strategic trading demands more than simply a knowledge of simple market trends. Successful traders appoint advanced techniques to crack market sentiments and make well-knowledgeable decisions. One such approach that has stood the check of time is the artwork of interpreting candlestick patterns. These visual representations of rate moves offer a wealth of data that could manual traders towards worthwhile results.

Understanding Candlestick Patterns

Candlestick patterns are a form of technical analysis that originated in Japan. They provide insights into price dynamics by visually showing the relationship between opening, closing, high, and low prices within a specific time frame. Observing the patterns formed by these candlesticks gives traders valuable insights into market psychology and potential trend reversals.

Traditionally, candlesticks were used once because each candle represents a full day’s worth of news, data, and price activity. This means that candles are more useful for long-term or swing traders.

The vital issue is that each candle has a story. The pleasant way to examine a candle is as a conflict between buyers and sellers. A light color candle (ordinarily green or white) suggests that the customers have gained, while a darkish candle (red or black) indicates that the sellers have gained. But the battle between buyers and sellers between the open and the close makes candlesticks useful as a charting tool.

How to Read a Candlestick Pattern

The opening, high, low, and closing (OHLC) daily candlestick shows market prices. The rectangular real body, or just the body, is colored dark (red or black) when the price goes down and light (green or white) when it goes up. The lines above and below the body are called “wicks” or “tails,” showing the day’s high and low points. When all the candlestick parts are looked at together, they can often show a change in a market’s direction or big possible moves that often need to be confirmed by the next day’s candle.

The Five Most Powerful Candlestick Patterns

Hammer and Hanging Man

The hammer and hanging man patterns are powerful indicators of trend reversals. The hammer, indicated by a small body and a long lower wick, suggests a potential bullish reversal after a downtrend. Conversely, the hanging man, similar in appearance to the hammer but occurring after an uptrend, signals a potential bearish reversal.

Bullish and Bearish Engulfing Patterns

The engulfing patterns, including bullish and bearish engulfing, are strong signals of a trend reversal. A bullish engulfing pattern occurs when a larger bullish candle fully engulfs the prior smaller bearish candle, indicating a potential upward shift. Contrarily, a bearish engulfing pattern suggests a potential downtrend reversal.

Morning and Evening Star

Morning and evening star patterns provide valuable insights into potential trend reversals. The morning star consists of three candles: a bearish candle, followed by a small-bodied candle, and a final bullish candle. This signals a potential bullish reversal. On the other hand, the evening star, with a bullish candle followed by a small candle and a bearish candle, indicates a possible bearish reversal.

Doji Candlesticks

Doji candlesticks represent uncertainty in the market. They occur when the opening and closing prices are virtually identical, resulting in a cross-like formation. Doji candles suggest that a trend reversal may be on the horizon, especially when they appear after a strong price movement.

Piercing and Dark Cloud Cover

The piercing and dark cloud cover patterns provide insights into potential reversals. The piercing pattern consists of a bullish candle following a strong bearish candle, indicating a possible upward reversal. Conversely, the dark cloud cover features a bearish candle following a strong bullish candle, hinting at a potential downward reversal.

Expert Tips for Trading with Candlestick Patterns

Confirmation is Key: While candlestick patterns provide valuable insights, it’s important to await confirmation from other technical indicators or market trends before making trading decisions.

- Combine Pattern: Professional traders often combine candlestick patterns with other technical tools, such as moving averages or RSI, for enhanced accuracy.

- Practice Patience: Only some patterns will result in a successful trade. Patience is essential, and traders should avoid overtrading based solely on candlestick signals.

Read More: How to Buy Bitcoin on eToro: A Comprehensive Guide

Pay close attention to small bodies and long tails

When a candlestick has a small body, like a doji, buyers, and sellers fight to a draw, so the close is almost the same as the open. (A candlestick like this could also have a very small base, making it look like a spinning top.) Small bodies show that the market is still determining what way it should go in right now.

This says that small bodies are often signs of a change in direction because the movement (up or down) may have lost steam. Keeping track of key uncertainty candles is important because either the bulls or the bears will win. Now is the time to wait and see how the price moves, but be ready to act when the market shows its hand.

Long tails are another important candlestick warning, especially when they come with small bodies. Long tails show that buyers or sellers tried but failed to move the price in the direction they wanted. Instead, the price went back to where it was near the open. The doji below is an example of this kind of design. It shows that the price tried to go up and down but stayed the same. After a move up, this suggests that the next move will be down.

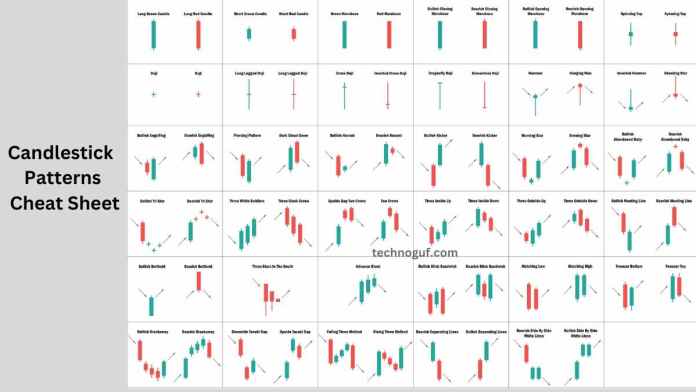

Candlestick Patterns Cheat Sheet

Read More: Forex Trading for Beginners: A Step-by-Step Guide

Conclusion

In the world of trading, gaining knowledge of candlestick styles is an impressive ability that empowers investors to anticipate market shifts and make well-timed, acquainted choices. By recognizing and interpreting the diffused alerts conveyed via those patterns, investors gain an aggressive facet within the complicated realm of financial markets. As you embark on your buying and selling adventure, remember that honing your proficiency in candlestick styles can be the key to unlocking constant fulfillment and accomplishing your financial goals.

Frequently Asked Questions (FAQs)

What are Candlestick Patterns?

Candlestick patterns are graphical representations of price movements in financial markets. They help traders visualize the relationship between opening, closing, high, and low prices for a specific period.

How are Candlestick Patterns Used in Trading?

Traders use candlestick patterns to predict potential price movements and market trends. By recognizing specific patterns, traders can make informed decisions about buying or selling assets.

Are Candlestick Patterns Reliable Indicators?

Candlestick patterns can offer valuable insights, but their reliability varies. Factors like market context, confirmation from other indicators, and timeframe influence their effectiveness.

Can Beginners Understand Candlestick Patterns?

Yes, beginners can grasp the basics of candlestick patterns. Learning simple ways like doji or hammer can provide a foundation for understanding market sentiment and making initial trading decisions.

Do Candlestick Patterns Apply to Different Markets?

Yes, candlestick patterns can be applied to various financial markets, including stocks, forex, commodities, and cryptocurrencies. The underlying principles of analyzing price movements remain consistent across different assets.